My wife and I are learning more than we wanted to know about the price of new driver insurance. Here’s why. We have an 18-year old daughter. This month our son turns 16. Unfortunately, he can’t wait to drive. Car insurance for us is already expensive. Now it’s going to be crazy expensive.

Here’s the quick summary of this post. When I first received the price increase for new driver insurance when my daughter turned 16 I wanted reliable data on what insurance should cost. I looked, but couldn’t find data on new driver insurance prices. Therefore, ValChoice set out to build a car insurance calculator. Building a car insurance price calculator was no small effort. “No small effort” is an understatement! Nevertheless, we did it. The result was that we were paying too much.

Are you paying too much too? Click the button below to find out. This is the only real car insurance calculator on the web, and it’s free to use. Best of all, we’re not trying to sell you insurance. Use this car insurance calculator as often as you want, no strings attached.

New Driver Insurance…”To Infinity and Beyond”

We’re a three car family. An old beat up car for me. A nice shiny new car for my wife. For my daughter, she got the keys to my wife’s previous car. Both my wife and daughter are pleased with this arrangement. Therefore, I’m pleased too. (Actually, I am quietly envious of my wife for having a nice new car. Oh well, maybe some day I can get a new car too.)

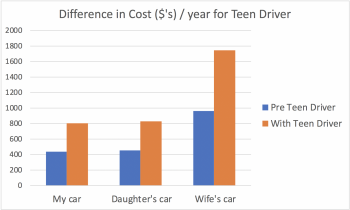

The chart below shows the insurance price per car, before and after adding the 16-year old driver.

Chart 1: Comparison of cost to insure each of three cars with and without a teenage driver. Total price increase equals 82%.

Before our daughter got her license, we were paying $1,861 per year to insure all three vehicles. This is of course more than I would like to pay, but seemed fair since this was full coverage on all three vehicles. We carry 250/500 liability and 100K property damage on all vehicles.

After she got her license the price went from $1,861 to $3,382 to insure all three vehicles. This is an 82% increase…spread across all three cars, even though our daughter only drives one car. Therein lies the surprise. “Why did the price increase on all cars,” I wondered?

“That’s How Insurance Works!”

I called my insurance agent to ask why the price nearly doubled on all three vehicles. His response was, “that’s the way it works.” To that proclamation I thought, “I doubt it. Why would a company make it appear as if they’re ripping you off by raising the price on three vehicles when the cost to insure them remains the same for two of the vehicles?” In short, this explanation did not pass a test of common sense.

Is it time for a new insurance company?

The obvious next step in the conversation was to request the agent to find me a new company. The agent gave me a variety of reasons why this may not be possible and wasn’t easy to do. I know enough about insurance to know that moving me to a different company is entirely possible. In terms of it not being easy to do, I didn’t really care about the work involved for the agent. After all, they’re not paying the $1,500 price increase, and they get a handsome 15% commission off of my business each year.

After some back and forth it turned out there may be one company that would sell us new driver insurance at a reasonable price. Unfortunately, the suggested company was a non-starter for me. The company was a not an option because ValChoice grades the company they wanted to move us too poorly. It should come as no surprise that I refuse to be insured by a company that is not rated well by ValChoice.

Is the agent telling me the truth?

Facing similar circumstances a normal person would do one of two things. Suffer in silence or move to another company. However, I didn’t choose either of these options. I wanted to understand the problem. Therefore, instead of calling another agent, I started collecting documents insurance companies file with state insurance regulators on how they calculate prices. Next, I actually read the documents. I read the documents to learn how car insurance for teenagers is typically handled by insurance companies.

Not at all to my surprise, the pricing my company proposed for dramatically raising the price on all three vehicles is not industry standard. Knowing this, the options became easy. First, I even more strongly doubted my insurance company was competitive when buying car insurance for teenagers. If true, I needed a new insurance company. Second, my insurance agent lied to me. That’s totally unacceptable.

What Came Next

At the top of this article I mentioned that a car insurance calculator is a big project. To do this, we collected thousands upon thousands of rate filings. Next, we converted the rate filings into a car insurance calculator for how most companies price. The process was interesting. We learned which companies charge too much. Which companies charge certain types of drivers (for example, women) too much. We learned which companies give a great initial rate, then raise the price faster than you can possibly imagine.

This all started when my daughter turned 16. Now she’s 18. Initially, we were paying about $500 per year too much for car insurance. That wasn’t enough to bubble up to the top of the priority list and switching companies. However, this year the company raised our rate by over $1,000. No accidents, no tickets, and car insurance pricing has been relatively flat. Now it’s time to change.

Why a thousand dollar increase?

Insurance pricing is interesting. As an industry observer we’ve noticed that while there are massive amounts of data available to calculate the cost of insuring, few companies do a good job of quickly consuming and analyzing the data. Therefore, change tends to occur slowly. This means that during periods of increasing costs, insurance companies tend to get behind and suddenly need to act urgently and dramatically. For consumers, this means change can be extreme.

In our case we were paying slightly too much. Now with a dramatic rate change, the insurance company is charging dramatically too much.

Save Money and Get a Better Insurance Company

After completing the car insurance calculator, use our best car insurance companies page to find an insurance company that provides a great product at a fair price. Click the button below to go to the best insurance companies listings.

Are you thinking about a specific company for your new driver insurance? If they appear on the best insurance company pages, go for it. They’re a good company. However, if they don’t appear on those pages, get a ValChoice rating before buying insurance from them. You can get a free rating by clicking the button below.

Note: ValChoice does not receive any payment from insurance companies for rating them. We pay to collect the data, do the analysis and publish the results. Insurance companies have no influence on any part of this process.

Comments are closed.