Do you wonder if increasing your car insurance deductible would save you money? Deductibles are a bit like gambling. Therefore, deciding whether to take the risk can be difficult. We have an easy way. We built the car insurance calculator to help with decisions like this. Finally, you can make these decisions on your own without the pressure of a sales person looking over your shoulder. Click the button below to go to the car insurance calculator and find out. It’s easy and it’s free.

How do I determine what my deductible should be?

Do you prefer videos over reading text? If so, watch this YouTube video about car insurance deductibles. ValChoice produced a series of educational videos. You can find them free-of-charge on the ValChoice Youtube channel. Below is a video specific to how deductibles impact the cost of car insurance.

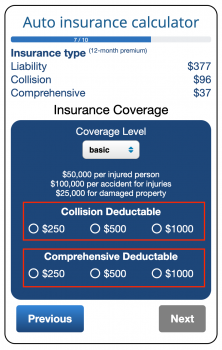

An image of the ValChoice car insurance estimator is shown below. This car insurance calculator is interactive. Therefore, as you enter data you will immediately see the calculations change. That’s why the app is so useful. You can see what the impact is on price as you make changes.

Go to the screen shown below in the ValChoice car insurance calculator and select the deductible level you prefer. You will see the impact on price.

Select “collision” deductible in the upper red box. Select “comprehensive” deductible in the lower red box.

To make the decision, we’ll do some simple math. Here’s how. Start with the collision deductible. First, choose the two most appealing options. For example, $500 or $1,000 deductibles. Start with the $500 deductible and make a note of what the collision price would be. Next, choose $1,000 deductible and see how much less the price would be with the larger insurance deductible. Let’s pretend the $500 deductible has a collision insurance cost = $115. Next, let’s assume the $1,000 deductible cost was = $100. Subtract $100 from $115. The difference is $15.

Next, divide $500 by 15. The answer is 34. Yes, you would need to go 34 years without a collision accident (one for which you’re responsible) to save more than the $500 change in deductible. Obviously, this does not make sense.

Finalizing the Insurance Deductible Amount

Lastly, now it’s time to decide on which deductible you prefer. If the math works out to take numerous years to recover the money from a single accident, don’t increase the deductible. Importantly, if you have teenage drivers on your policy, keep the lower deductible. Unfortunately, the odds are that teen drivers will have an accident. Therefore, if the price difference is minimal, stay with the lower deductible amount.

What About comprehensive insurance deductibles?

Repeat the process described above for the comprehensive insurance deductible. The process is exactly the same. The numbers will be different, but the process is the same.

What about the liability insurance deductible?

Deductibles do not apply to liability insurance. Therefore, the calculator only presents deductible options for collision and comprehensive insurance. The reason for this is that your liability insurance covers the other person, when you care the accident. Hence, when the other party is covered, there are no deductibles to be paid.

When do I pay the deductible?

If you have an accident and need the collision coverage to repair your vehicle, you will need to pay the additional $500.

How often do I need to pay my insurance deductible?

You may ask if deductibles apply to all types of insurance, and how often? For car insurance, deductibles are typically applied to each claim. Similarly, deductibles also apply to each claim with homeowners insurance. However, some types of insurance only require the policyholder to pay the deductible amount annually. This is often how health insurance works.

The ValChoice Car Insurance Calculator

ValChoice is focused on helping people with insurance by delivering transparency. Detailed analysis of insurance prices shows that insurance price variations can be extreme. Shockingly, comparing the exact same coverage, person, car, etc often results in price differences of 500%.

We immediately recognized that consumers need a fair, unbiased, free service that lets them know what is a fair price for insurance. That’s what our car insurance calculator does. Try it out. Tell a friend about it.

Best Insurance Companies in Your State

Want to know the best auto insurance and best home insurance companies in your state? It’s easy. ValChoice publishes the five best insurance companies in every state. Simply click the buttons below to find out the best insurers in your state.

ValChoice does not get paid to rate insurance companies. ValChoice rates every auto and home insurance company in every state where they do business.

No comments yet.