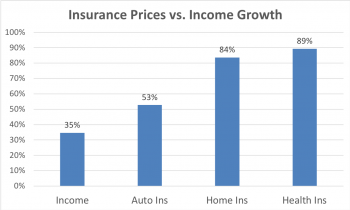

Hold on to your hat, this is going to surprise you. It’s true, home insurance prices have been increasing more than double the rate of median family income. We collected data going back to the year 2000 from the federal reserve board. Yes, that’s a reliable data source. Then we did the calculations. Surprisingly, home insurance prices have been going up at a rate similar to health insurance.

What should the price of your home insurance be?

How good is your insurance company? Don’t believe the ads!

Be sure to checkout your home insurance company. Get a free rating on any company by clicking the button below. We can tell you how good they are about paying claims, if they provide a good value and what their overall service level is like.

About The ValChoice Home Insurance Calculator

We developed the home insurance premium calculator so homeowners can easily monitor the price they pay. To do this, we created a premium calculator for every state in the U.S. In fact, we even included the District of Columbia. Finally, you can know if the price you’re paying for home insurance is fair.

You may ask, “why 51 versions?” There are two reasons. First, prices for home insurance vary dramatically from state to state. That necessitated 50 calculators. Second, we didn’t want to leave Washington D.C. out, so we added one more.

Importantly, the analysis we did was based on data collected before the catastrophic storms of 2017. That means this rapid rate of price increases isn’t going to change anytime soon.

Rate of Increase in Insurance Prices vs. Family Income

The chart below depicts the difference in growth rate of median household income compared to the types of insurance families must buy. The chart shows that both health and home insurance prices have been increasing more than twice as fast as median household income. Even car insurance rates have been increasing much more rapidly than median family income.

The data analyzed for the chart above covered the period from 2000 to 2015. The source of the data was the Federal Reserve board. https://fred.stlouisfed.org.

More Information on Home Insurance Prices in Your State

The links at the bottom of this page go directly to web pages with more information about auto and home insurance in your state. A homeowners insurance price calculator specific to your state is included on each of the state pages. For your convenience, links to all states are included below. Just click on your state. Once there, go to the home insurance section where you will find the rate calculator.

The Easiest Way to Shop for Insurance

Until now, it was hard to know much about insurance, other than the price. We’re changing that. You can think of ValChoice as “Big Data for Consumers.”

If you’re paying more than our premium calculator says you should, click the button below to Compare Home Insurance Companies. We will show you how three of the best home insurance companies in your state compare to your current company. Now you know where to shop to get a fair price and great protection. Don’t be surprised if none of the best home insurance companies we name advertise on TV. That’s not how the best companies spend your money.

Importantly, we don’t get paid when you buy insurance. That means we won’t encourage you to change companies unless we believe changing is in your best interest.

Click the button below to get a report comparing your home insurance company to three of the best in your state.

Note: ValChoice does not receive any form of compensation from insurance companies for presenting them as a good option in our car and home insurance reports.

Homeowners Insurance in Your State

Below are links to all 50 states and Washington D.C. Click the link to your state for average home insurance price information, and much more.

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

No comments yet.