Do you ever wonder whether gender affects car insurance quotes and prices? It does. Even in states where by law they don’t allow using gender as a factor, there’s still an impact on the premiums people pay. Click the button below to find how gender affects car insurance quotes and rates in your state.

What is the difference in car insurance quotes, by gender?

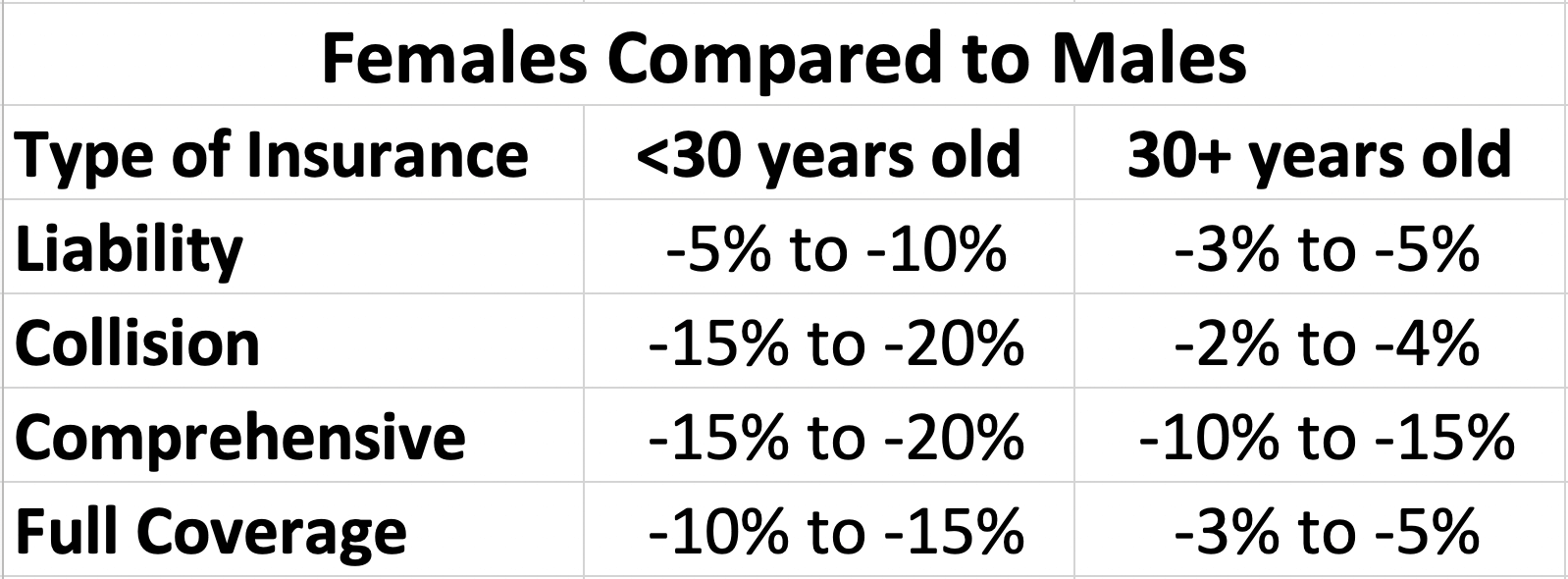

In most states, women pay significantly less than men. To summarize the difference, we break the market into two segments: less than 30 and 30 plus years of age. As shown in the table below, women pay significantly less than men for car insurance in the less than 30-year old group. For 30 and over, women still pay less than men, but the difference is not as significant.

The table above summarizes the differences in car insurance quotes and premiums for women vs. men. The figures in the table above assume everything else is the same: address, age, driving record, etc.

Car Insurance Calculator Shows the Details of Car Insurance Quotes

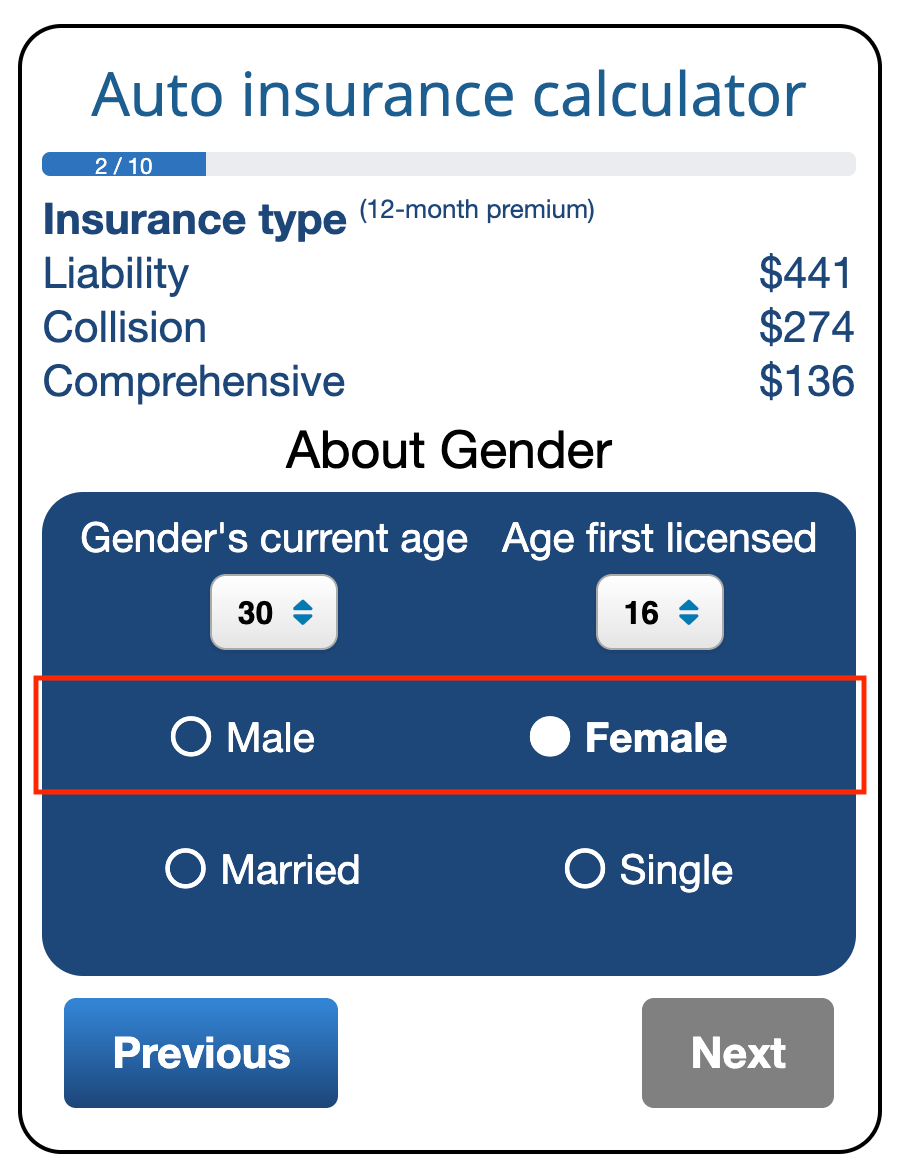

You can estimate the difference between car insurance quotes for males and females for where you live by using the ValChoice car insurance calculator. Start by entering address and zip code. Next, go to the second page where you will be prompted to enter gender. This is where you can see the difference in car insurance price between males and females. A screenshot of the calculator is shown below.

The ValChoice car insurance calculator is interactive. Hence, as soon as you enter data you will immediately see the calculations change. You can simply switch back and forth between male and female and see the impact on car insurance premium.

States that don’t allow gender to be used when calculating car insurance quotes.

At the time of this writing, there are six states that don’t allow gender to be used in calculating car insurance premiums. Those states include:

- California

- Hawaii

- Massachusetts

- Montana

- North Carolina

- Pennsylvania

California women get more than a half a billion dollar price increase

We were curious what the cost is to women when states don’t allow gender to be included in calculating car insurance premiums. To do this, we used the state of California and did the math. The net result, California women now pay nearly $700 million per year more than before. And that’s assuming men got an equivalent discount (not necessarily a good assumption). Potentially, men got no discount and women got all the increase.

The math is easy. California was a $31.1 billion car insurance market in 2019. Women typically pay (across all insurance types and ages) approximately 4.3% less than men. 4.3% of $31.1 billion is $1.3 billion. Divide that by two to calculate a straight reduction for men and increase for women. Again, not necessarily a good assumption.

Amazingly, this rate increase was based on the stroke of the pen by an outgoing state insurance commissioner. This was not a new law passed by the state legislature.

The ValChoice Car Insurance Calculator

ValChoice is focused on helping people with insurance by delivering transparency into what has been an opaque industry. After doing a detailed analysis of insurance prices, we found the price variations to be extreme. Shockingly, comparing the exact same coverage, person, car, etc across different insurance companies can result in a 20x difference in price. Across seven common scenarios we tested, we found an average of an 8x difference.

We immediately recognized that consumers need a fair, unbiased, free service that lets them know what is a fair price for insurance. That’s what our car insurance calculator does. Try it out. The calculator will help make sure you’re getting a fair price. If the price you have is not relatively close, get a quote from a high-quality insurance company.

Does insurance quality interest you?

Billions of dollars are spent each year by State Farm, GEICO, Progressive and others telling consumers that the most important aspect of insurance is price. That may be true for people that don’t want the insurance in the first place. However, for those that want good protection, quality is also important. Not all insurance is the same quality. To find the best insurance companies in your state, click the buttons below.

Other Ways ValChoice Helps Consumers

In addition to the calculator and lists of the best companies, ValChoice also provides ratings. We rate insurance companies based on quality, value and service. Click the buttons below to get a rating on your insurance company. If it’s good, tell a friend. If it’s bad, find a new company. You can use our list of the best companies above to find good companies.

Note: ValChoice does not get paid by insurance companies to rate them. We do this as a service to consumers. The objective of these ratings is to enable consumers to buy insurance based on quality and value.

No comments yet.