The million dollar question. How much liability insurance do I need? Am I adequately protected? Alternatively, am I overprotected and I’m wasting money? These are important questions. We make the answers easy.

First, are you with a good insurance company? Hint, spending a lot on advertisements doesn’t mean they’re a good company. It only means they’re spending part of what you pay them to get more customers rather than on protecting current customers. Simply click the buttons below to understand how good your insurance company is.

How much liability insurance should I have?

The amount of liability insurance protection you buy depends on your personal financial situation. Here’s a rule to live by. Always maintain more liability insurance than the sum total of your personal assets. Here’s why. If someone sues you, the insurance company will pay up to the “limits” of the insurance policy. When you get sued for more than policy limits, and lose, you pay. That’s right, you pay the additional amount owed after the insurance company pays the limits of the policy.

Low-Cost Insurance can Victimize People

How long can you have the TV on without seeing an insurance company ad? Answer, not every long. In fact, if your watching a sporting event, there’s probably an insurance ad in the next ad break. Just the three largest auto insurance companies — State Farm, GEICO and Progressive — spent nearly. $5 billion on advertisements in 2019. Unfortunately, much of this money is spent claiming to have the best price. We call this unfortunate because these ads are working to commoditize insurance. In reality, protecting assets you’ve built over a lifetime deserves more consideration than just price.

Unfortunately, the primary way of selling low-cost insurance is to limit liability protection. Some insurance companies will cover virtually anybody. However, they will only offer state minimums for liability protection. This limits the exposure of the insurance company. If something bad happens, it’s on you.

What’s a fair price for my liability insurance?

The price of insurance varies wildly. For example, you could pay $1,000 for insurance with one company, but with a different company, pay $5,000, for exactly the same coverage. ValChoice built the car insurance calculator so you can determine a fair price. Just click the button below to see what liability insurance should cost you.

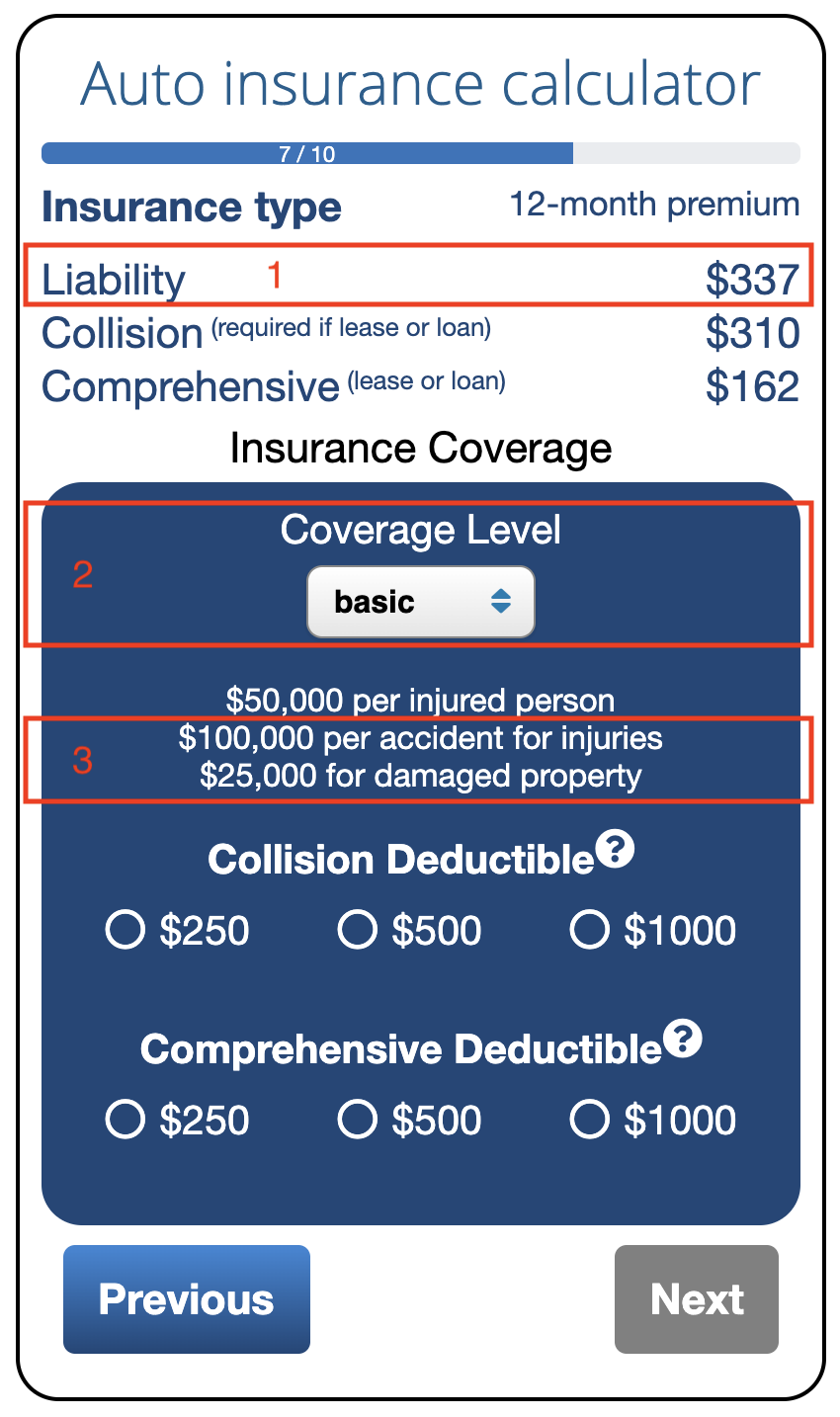

To determine a fair price for liability coverage, enter the information required until you get to the screen shown in the image below.

Next, we start looking at options. Read on for how to asses your options.

Liability Insurance Cost

Item one (1) in the image above shows the liability insurance cost. Liability insurance is required by law. Collision and comprehensive insurance is not required by law. However, if you have a loan or lease, the lender will require collision and comprehensive insurance.

Coverage Level

Item two (2) specifies how much liability insurance you want. Change the coverage amount and you will see the cost estimate shown in line one change.

How Much Liability Insurance to Purchase

This is the important point. Insurance protects your financial assets. Your assets are not fully protected if you have too little liability insurance. Here’s how to determine how much liability insurance you need. In box three (3) add those two numbers together. In the image above, the numbers are $100,000 and $25,000. This sums to $125,000. If you have personal assets more than $125,000, you’re underinsured. Therefore, if you lost a lawsuit for more than $125,000 you would be responsible for paying the amount that exceeds $125,000.

What to do if you’re underinsured. Change the selection in box 2 from the image above. Next, keep changing the selection in box two (2) until the sum of the numbers in box three (3) is greater than your personal assets.

How good is your insurance company about paying claims?

Claims handling is an important consideration when buying insurance. In particular, if you buy more than state minimums for insurance, you need to consider claims handling as an important factor. ValChoice rates every car and home insurance company in the country, by state where they do business. Click the buttons below to get a free rating on your insurance companies.

Finding the Best Car Insurance and Best Home Insurance Companies

Some people want to make sure they have the best insurance protection. This doesn’t mean spending a lot of money. Instead, best insurance means companies that make a business out of paying claims quickly and without hassle. ValChoice rates every auto and home insurance and lists the best companies by state. Click the buttons below to find the best insurance companies in your state.

Insurance companies do not pay ValChoice to rate them. ValChoice insurance company ratings use only the highest quality data.

No comments yet.